Your Checlist For A Deceased Person

Your Checklist For A Deceased Person

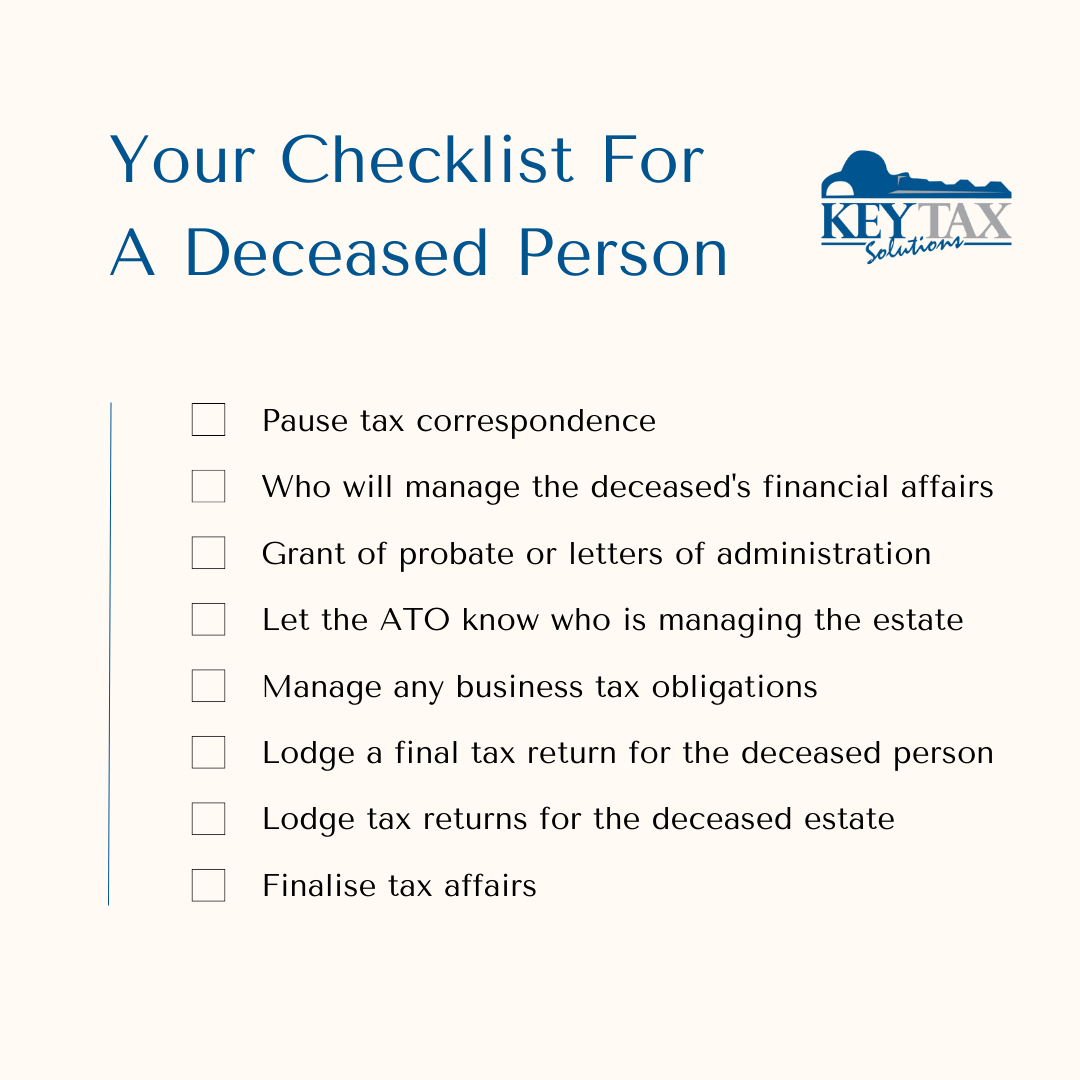

𝐘𝐨𝐮𝐫 𝐂𝐡𝐞𝐜𝐤𝐥𝐢𝐬𝐭 𝐟𝐨𝐫 𝐚 𝐝𝐞𝐜𝐞𝐚𝐬𝐞𝐝 𝐩𝐞𝐫𝐬𝐨𝐧

𝟏. Pause tax correspondence

Get in touch with the ATO to advise them your family member has passed away.

𝟐. Determine who will manage the deceased's financial affairs

The Will should nominate someone as the executor, the executor is responsible to manage the financial affairs of the deceased.

𝟑. Decide if you need a grant of probate or letters of administration

If the deceased does not have will you may need to apply for letter of administration. Probate will legally recognise the will. The process can be overwhelming, seek assistance from a solicitor.

𝟒. Let the ATO know who is managing the estate

Advise the ATO that you, the executor, have the authority to act on behalf of the deceased.

𝟓. Manage any business tax obligations

If the deceased is running a business, you will need to get all BAS and income tax obligations up to date. If the deceased was a director of a company, ensure you have the authority to act as the director.

𝟔. Lodge a final tax return for the deceased person

You will need to ensure all the outstanding tax returns for the deceased are lodged. Please note, any income earned after the date of death is not included on their final return.

𝟕. Lodge tax returns for the deceased estate

If the deceased has significant assets, you may need to create a Deceased Estate Trust, your accountant will be able to guide you on this. For three years after death, the deceased estate trust is taxed as an individual.

𝟖. Finalise tax affairs

Ensure all tax returns are lodged before distributing the funds from the estate. As the executor, you can be held personally liable for unpaid tax of the estate.

What We Do

At Key Tax Solutions we aim to provide you with advice when your business needs it, not just when you ask for it.

Who we are

At Key Tax Solutions we are committed to forming close partnerships with our clients, enabling us to understand your unique situation and customise the assistance we provide to suit your requirements.

Resources

At Key Tax Solutions we offer a full range of free, easy to use, online resources.

Meet The Team

Contact / Connect

Rabbitohs

Rabbitohs

Xero

Xero

Quickbooks

Quickbooks

MYOB

MYOB

Tax Agent

Tax Agent

CPA

CPA